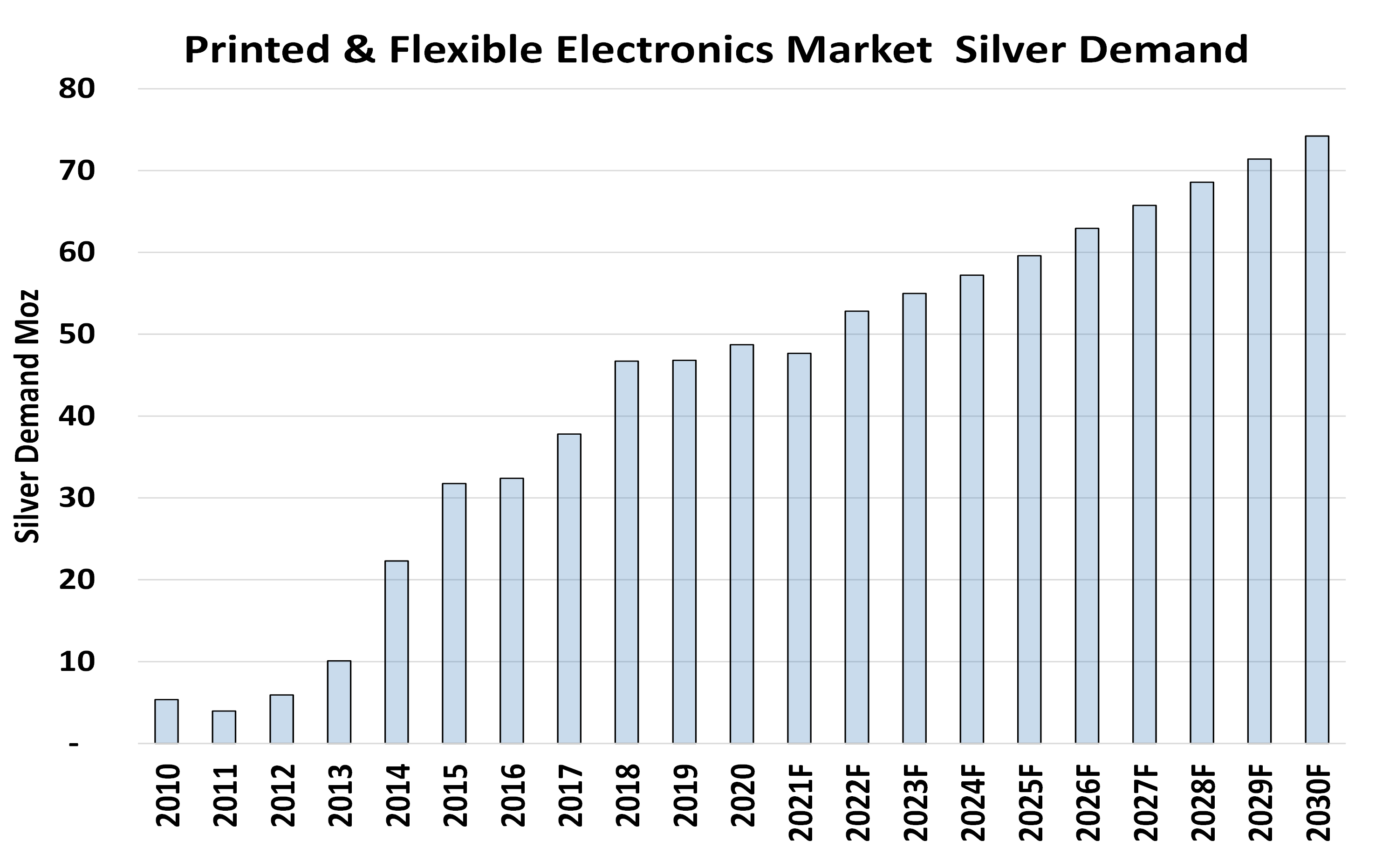

Silver prices continue their remarkable rally into late 2025, with the spot price hovering around $69 per troy ounce as of December 22. This marks a significant surge from earlier in the year, driven by strong industrial demand, supply constraints, and safe-haven buying. The precious metal has gained over 130% year-to-date, making it one of the top-performing commodities.

https://silverprice.org/silver-price-history.html

Current Silver Spot Price Details (December 22, 2025)

- Spot Price per Troy Ounce: Approximately $68.76 – $69.26 USD (variations across sources due to live market fluctuations).

- Daily Change: Up 2-2.5% in recent sessions.

- Per Gram: ~$2.23 USD.

- Per Kilogram: ~$2,226 USD.

Prices update in real-time during market hours. The surge reflects robust demand from solar panels, EVs, and electronics, combined with ongoing market deficits.

https://www.ebc.com/forex/silver-prices-forecast–how-high-can-it-reach

Why Silver Prices Are Surging in Late 2025

Silver’s 2025 performance stands out with gains exceeding 130-140% YTD—the strongest since 1979. Key factors:

- Industrial Demand Boom: Solar, EVs, and data centers drive consumption.

- Supply Squeeze: Persistent deficits for five years, with tight London market conditions.

- Safe-Haven Appeal: Geopolitical tensions and currency debasement boost precious metals.

- Investment Inflows: ETF buying and speculative interest.

Analysts predict continued strength into 2026, with deficits persisting.

Outlook and Investment Considerations

Silver trades at multi-decade highs, with some forecasts eyeing $70+ soon. Long-term bulls cite structural deficits and green tech growth.

For investors: Physical bullion (coins/bars) or ETFs offer exposure. Prices fluctuate—consult professionals.

Sources: Trading Economics, JM Bullion, Fortune, APMEX, Kitco, Monex.

more finance news